Setting up Fund Management Company in Singapore

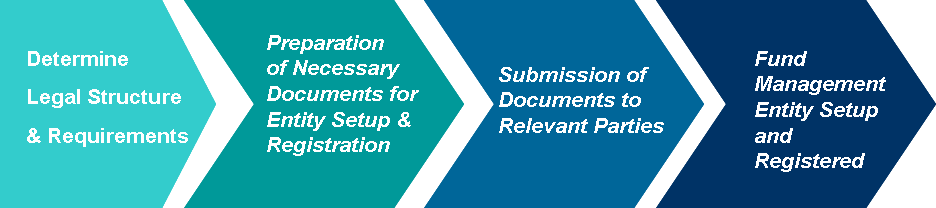

Determining the ideal fund management corporate structure is crucial. Common concerns are which jurisdiction they should set up their fund and management entity, what kind of structure they should expect to set up for their potential investors, and the tax benefits of the intended corporate structure. VALON will work with you on deciding the ideal corporate structure for you and your investors, help you with preparation of documents and forms to be submitted to Monetary Authority of Singapore (MAS) should you decide to set up your fund company in Singapore, and incorporation of onshore and offshore entities.

The activity of fund management is defined in the Second Schedule to the Securities and Futures Act (SFA).

Categories of Singapore Fund Management Companies

These corporations, which will be referred to in these Guidelines as Fund Management Companies [“FMCs”], may either need to either hold a CMS licence in fund management as a Licensed FMCs Licensed FMCs [“LFMCs”], or be registered with MAS as an Registered FMCs [“RFMCs”].

- Licensed retail FMCs

These are FMCs which carry on business in fund management with all types of investors. The FMC should put in place an independent and dedicated compliance function in Singapore with staff who are suitably qualified and independent from the front office. Representatives will need to pass a Capital Markets and Financial Advisory Services (“CMFAS”) examination module. This is to ensure that the public interest is protected since these FMCs deal with the general public who are often not as well informed as accredited or institutional investors.

2. Licensed A/I (Accredited / Institutional) FMCs

Licensed A/I FMCs are those which require a CMS license to operate in Singapore. FMCs which only serve A/I investors and whose AUM is more than SGD250 million; or FMCs who manage more than 15 funds with underlying investors who are accredited or institutional investors, will fall within this category.

Unlike the old EFM regime or the new Registered FMC regime, there are no restrictions on the number of accredited or institutional investors a Licensed A/I FMC can serve. This would certainly be welcomed by most fund managers targeting to service more than 30 investors.

3. Registered FMCs

A Registered FMC will be exempt from holding a Capital Markets Services (“CMS”) license in relation to the conduct of fund management activities. Hence, entities which were previously operating as EFMs will now be known as Registered FMCs.

To qualify as a Registered FMC, assets under management (“AUM”) should not exceed SGD250 million and the FMC must not serve more than 30 qualified investors. Of these 30 qualified investors, there cannot be more than 15 funds (including feeder funds) with accredited investors as underlying investors.

Under the previous framework, the EFM could commence business once they lodged the requisite notification with the MAS. However, a Registered FMC may only commence business when the MAS approves its notification and has entered the Registered FMC’s name into the online directory on MAS’s website.

| Category | Permissible Activities | |

| LFMCs | Retail | Carrying on business in fund management with all types of investors. |

| Accredited / Institutional | Carrying on business in fund management with qualified investors only, without restriction on the number of qualified investors. | |

| RFMCs | Carrying on business in fund management with no more than 30 qualified investors (of which no more than 15 days may be funds or limited partnership fund structures) AND the total value of the assets managed does not exceed S$250 million. | |

Investors

A/I LFMCs and RFMCs should not target retail investors through the use of investment structures that circumvent clientele class restrictions. The following are illustrations of how A/I LFMCs and RFMCs may carry on business in fund management:

- In limited partnership fund structures, the general partner will typically be an FMC, with third party investors participating as limited partners. On occasion, the general partner may be a company controlled by the FMC, rather than the FMC itself. In the latter circumstance, so long as the general partner is ultimately owned by key officers and/or shareholders of the FMC, the FMC may continue to manage the fund as an A/I LFMC or RFMC (as the case may be), notwithstanding that the general partner does not meet the requirements of an accredited investor or institutional investor.

- A/I LFMCs and RFMCs may carry on fund management business with their employees only if these employees meet the definition of an accredited investor.

Research and Advisory

A person that acts as investment advisor, sub-advisor or provides research to other investment managers (either in Singapore or overseas) would be considered to be conducting fund management activity if the person is able to exercise direct or indirect control over the management of the investment portfolio.

In determining whether such a person is able to exercise control over the investment portfolio, MAS may consider factors such as whether the person is involved in the construction of the investment portfolio; has knowledge of, or access to the holdings of the portfolio beyond what is publicly available; or is named or referred to in the fund’s prospectus, offering documents or marketing materials.

Minimum Competency Requirements for Singapore Fund Management Company Registration and Ongoing Obligation

Please refer to Appendix 1 on the minimum competency requirements for each FMC category.

Minimum Compliance Requirements for Singapore Fund Management Company Registration and Ongoing Obligation

Please refer to Appendix 2 on the minimum compliance requirements for each FMC category.

Managed Assets

MAS requires that an FMC that acts as investment adviser, sub-adviser, or that provides research to another investment manager should satisfy itself that the assets that it advises on be held by an independent custodian, i.e. prime broker, depositories or banks that are properly registered or authorised in their home jurisdiction, although it recognises that private equity and wholesale real estate funds can adopt other methods, subject to appropriate disclosures and other safeguards.

The assets under management must be subject to an independent valuation carried out by a third party service provider or by an in-house fund valuation function under certain conditions.

In determining the value of assets being managed, an FMC should take note of the following:

- An FMC conducting fund management activity as set out in the “Research and Advisory” section above should report, as assets under the FMC’s non-discretionary management, the moneys and assets contracted to the investment manager in respect of which the FMC has an agreement to provide the fund management services. In reporting these assets, the FMC should only include the portion that is attributable to it based on appropriate proxies such as the geographical or sectoral focus of the FMC.

- Moneys committed by the investors but not drawn down should be excluded from the FMC’s managed assets; and

- Given that managed assets should be based on the net asset value of the assets being managed, any leverage to which the managed assets are exposed should be excluded from the FMC’s managed assets.

- An RFMC should periodically monitor the size of the assets being managed, for the purpose of ensuring that it is adhering to the limit of S$250 million prescribed for RFMCs. An RFMC should, among other things, consider potential changes in the size of the assets being managed arising from prospecting of new investors or investment mandates. An RFMC which is managing private equity investments, or funds that operate on committed capital basis, should consider the total committed capital of these funds when considering whether its business model meets the thresholds for RFMCs.

Base Capital

An FMC shall at all times meet its prescribed base capital thresholds according to its license category, upon obtaining its licence or being registered with MAS. It would be prudent for the FMC to maintain an additional capital buffer, over and above the requisite base amount. An FMC should make a reasonable assessment of the amount of additional capital buffer it needs, bearing in mind the scale and scope of its operations.

| Category | Base Capital Requirements |

| a) Carrying out fund management in respect of any CIS offered to any investor other than an accredited or institutional investor. | S$1,000,000 |

| b) Carrying out fund management (non-CIS) on behalf of any customer other than an accredited or institutional investor. | S$500,000 |

| c) Carrying out fund management other than that described in (a) or (b) above. | S$250,000 |

Risk-Based Capital

An LFMC shall at all times meet the risk-based capital requirement in the SF(FMR)R upon obtaining its licence.

| Category | Risk-based Capital Requirements |

| Retail LFMCs | Financial resources are at least 120% of operational risk requirement. |

| A / I LFMCs |

Risk Management Framework

An FMC is required to put in place a risk management framework to identify, address and monitor the risks associated with customer assets that it manages. The FMC should take into account the principles set out in the MAS Guidelines on Risk Management Practices that are applicable to all financial institutions and any other industry best practices that might be relevant. An FMC should also be cognizant that these risks are dependent on the nature and size of its operations and the nature of assets that it manages. At a minimum, the risk management framework of an FMC should address the following:

(i) Governance, independence and competency of the risk management function

(ii) Identification and measurement of risks associated with customer assets

(iii) Timely monitoring and reporting of risks to management

(iv) Documentation of risk management policies, procedures and reports

Business Conduct

An FMC is required to comply, on an ongoing basis, with all applicable business conduct requirements set out in the SFA and SF(LCB)R, as well as in the Notices issued by MAS that are applicable to the FMC.

AML/CFT Requirements

An FMC shall comply with the requirements on Anti-Money Laundering and Countering the Financing of Terrorism [“AML/CFT”] requirements set on them. This includes which regard tax crimes as money laundering predicate offences. FMCs holding the proceeds of tax crime (regarded as such in Singapore or elsewhere) can face criminal prosecution for laundering the proceeds of criminal activities under the Corruption, Drug Trafficking and Other Serious Crimes (Confiscation of Benefits) Act.

Internal Audit

FMC is expected to be subject to adequate internal audit. The internal audit arrangements should be commensurate with the scale, nature and complexity of its operations. The internal audit may be conducted by the internal audit function within the FMC, an internal audit team from the head office of the FMC, or outsourced to a third party service provider.

Independent Annual Audits

An FMC shall meet the annual audit requirements as set out in the SFA and SF(LCB)R. MAS may direct the FMC to appoint another auditor if the appointed auditor is deemed to be unsuitable, having regard to the scale, nature and complexity of the FMC’s business.

Letter of Responsibility

Where appropriate, MAS may require LFMCs to procure a Letter of Responsibility from the LFMC’s parent company.

Reporting of Misconduct

All LFMCs shall comply with the misconduct reporting requirements set out in the Notice on Reporting of Misconduct of Representatives by Holders of CMS Licence and Exempt Financial institutions [SFA04-N11].

Use of Service Providers

Prior to entering into arrangements with service providers (such as a compliance service provider or a fund administrator), an FMC should take into account the requirements set-out in the MAS Guidelines on Outsourcing.

Notifications & Approvals

An FMC is required to comply with its obligation to notify MAS or to seek MAS’ approval, as the case may be, for relevant transactions and changes in particulars. An FMC shall also notify MAS immediately if it breaches any licensing or registration requirement, as well as take immediate steps to rectify the breach.

Periodic Returns

An FMC is required to submit periodic regulatory returns in relation to its fund management activities.

Professional Indemnity Insurance (PII)

MAS may impose a licence condition requiring a Retail LFMC to obtain PII that complies with the minimum requirements set out by them, where the amount of PII coverage is primarily based on the amount of assets under management. A/I LFMCs and RFMCs are strongly encouraged to maintain adequate PII coverage. They should disclose to all customers, both potential and existing, its PII arrangements or the absence of such arrangements.

Domestic (Onshore) Funds

Domestic or Onshore funds are Singapore domiciled funds. Domestic funds can be offered to both domestic and foreign investors but conventionally it is marketed to the domestic investors only.

Offshore Funds

Foreign or Offshore funds are funds established in jurisdictions other than Singapore.

Offshore Fund Managers promoting to Singapore investors must be licensed or regulated in the jurisdiction of its principal place of business and be fit and proper. Offshore hedge funds offered to retail investors in Singapore are called Recognized unit trusts.

Taxation

An Onshore fund will generally be liable to Singapore income tax if it derives income sourced or deemed to be sourced in Singapore or receives foreign-sourced income in Singapore. A domestic fund is generally required to file an annual tax return with the Singapore tax authorities. Onshore funds which are established as Singapore-resident companies can generally avail of Singapore’s double tax agreements provided these funds can fulfill the relevant substance requirements.

Tax exemptions are available under the Singapore Income Tax Act (SITA) for foreign-sourced dividend, foreign branch profits, and foreign-sourced service income received or deemed received in Singapore, subject to conditions. Gains or profits which are capital in nature are not subject to Singapore income tax.

A foreign or Offshore fund distributed in Singapore which are not managed/ advised by a Singapore resident fund manager/ investment adviser are generally not subject to tax in Singapore and are not required to file an annual tax return to the Singapore tax authorities. However Offshore Funds are deemed to have permanent establishment in Singapore by virtue of their Singapore based fund managers, therefore are deemed to generate earnings from Singapore therefore are invariably subjected to tax. In this case, the foreign fund may be required to file a tax return with the Singapore tax authorities. In cases where no income is subject to Singapore tax, there could be reporting requirements for a foreign fund.

Tax Exemptions for Offshore Funds (Section 13CA of Singapore Income Tax Act)

An offshore fund that is managed by a Singapore-based fund manager (registered with the MAS or holding a CMS licence or expressly exempted from holding a CMS licence) is exempt from Singapore tax on specified income from designated investments, provided the offshore fund is a qualifying fund. Specified income refers to profits, gains, dividends and interest from designated investments. Designated investments include traditional investments such as stocks, shares, securities, bonds, deposits, futures contracts etc. A qualifying fund is one that:

- Is not 100% beneficially owned by Singapore investors including Singapore resident individuals, Singapore resident corporate entities and Singapore-based permanent establishments of non-residents;

- must not be tax resident in Singapore;

- Does not have a Singapore presence (other than the Singapore fund manager and/or Singapore based trustee if the fund is organised as a trust); and

- Can only be in the form of companies, trusts or individual accounts.

Non-qualifying investors (i.e. Singapore non-individuals investing above a certain percentage in the fund) would need to pay a penalty to the Singapore tax authorities.

Note: i) A limited partnership cannot be a qualifying offshore fund since it is treated as a transparent entity for Singapore tax purposes. The partners in such limited partnerships would need to meet the qualifying conditions.

Tax Exemptions for Onshore Funds (Section 13R of Singapore Income Tax Act)

Tax exemption scheme is extended to funds constituted in Singapore as well, subject to the following conditions:

- The fund vehicle must only be a company constituted in Singapore;

- The fund manager must be constituted in Singapore, and registered with the MAS or holding a CMS licence;

- The fund must have its administration performed in Singapore;

- The fund must have at least S$200k local business spending per year;

- The fund must not be 100% beneficially owned by Singapore investors (excluding another approved fund holding 100% of the shares in the onshore fund);

- There is no change in investment strategy after approval; and

- Approval from MAS is required, unlike the Tax Exemption Scheme for Offshore Funds.

Non-qualifying investors (i.e. Singapore non-individuals investing above a certain percentage in the fund) would need to pay a penalty to the Singapore tax authorities.

This scheme has boosted the fund management industry in Singapore as it offers an additional advantage of Singapore’s extensive treaty network that helps to reduce tax liability in treaty countries that the fund invests in.

Enhanced Tier Fund Tax Exemption Scheme (Section 13X of Singapore Income Tax Act)

An enhanced tier fund tax exemption scheme is extended to funds that meet the following conditions:

- The fund’s legal form may be a company, trust (exceptions apply) and limited partnerships(no look-through);

- The fund may be offshore or onshore (there is no restriction on investment by Singapore investors);

- The fund manager must be Singapore-based and registered with the MAS or holding a CMS licence or expressly exempted from holding a CMS license;

- The fund size must be of S$50 million (committed capital concession available for real estate, infrastructure and private equity funds) and to rely on the committed capital concession discussed, a component of payments made to the fund manager must be charged based on the committed capital (i.e. undrawn amounts included);

- The fund must have at least S$200k local business spending per year;

- Required to have a Singapore-based fund administrator if the fund is a Singapore incorporated and resident company;

- There is no change in investment strategy after approval;

- Approval from MAS is required; and

- Cannot concurrently enjoy other tax incentives.

Under the enhanced tier there will are no restrictions imposed on the residency status of the fund vehicles as well as that of investors. The enhanced tier also applies to funds that are constituted in the form of Limited Partnerships. It can also apply to a Master-Feeder structure, including one that holds investments via special purpose vehicle(s) subject to conditions, i.e., all entities within the structure would be covered collectively without being required to meet the economic conditions separately. However, other conditions would need to be satisfied to apply the economic conditions on a collective basis.

Concessionary Tax Rate for Fund Managers

Under the Financial Sector Incentive Scheme for Fund Managers, fund managers in Singapore are taxed at a concessionary rate of 10% on fee income, subject to certain conditions and MAS approval. For new applicants to qualify for a minimum 5 year award, the qualifying criteria are that the applicant:

- must be registered with the MAS or hold a CMS licence or expressly exempted from holding a CMS licence in respect of its fund management activities;

- must have at least three professional staff engaged only in fund management or investment advisory services. ‘Professional’ is defined as an executive who earns a basic monthly income of more than SGD 3,500, and is engaged substantially in the FSI qualifying activity; and

- must have a minimum Asset Under Management (“AUM”) of S$250 million. Based on current regulatory conditions, a Registered Fund Manager should only be able to manage monies of not more than S$250million. As such, a fund manager with a Registered Fund Manager status may have difficulties qualifying for the FSI-FM incentive.

In addition, the MAS may also take into consideration factors like growth targets in terms of assets under management, business spending and the number of professionals when assessing the eligibility of the applicants for the FSI-FM award.

Appendix 1: Minimum Competency Requirements for Singapore Fund Management Company Registration and Ongoing Obligation

| RFMC | A/I LFMC | Retail LFMC | |

| Directors | |||

| No. of Directors | At least 2 | At least 2 | At least 2 |

| Minimum no. of years of relevant experience^: | 5 | 5 | 5 |

| Of these Directors, | |||

| i) No. of Executive Directors employed full-time in the day-to-day operations of the company and should be resident in Singapore. | At least 1 | At least 1 | At least 1 |

| ii) Minimum years of relevant experience^ of Chief Executive Officer [“CEO”] | 5 | 5 | 10 |

| Note: The duties of a director and CEO are spelt out in the SF(LCB)R. Nominee directors such as legal advisers or corporate secretaries will not count towards meeting this requirement. | |||

| Relevant Professionals | |||

| No. of relevant professionals residing in Singapore: | At least 2 | At least 2 | At least 3 |

| Minimum no. of years of relevant experience^: | 5 | 5 | 5 |

| Note: Relevant professionals would include the directors, CEO and representatives of the FMC. | |||

| Representatives | |||

| No. of representatives residing in Singapore: | At least 2 | At least 2 | At least 3 |

| Note: Representatives are individuals who conduct the regulated activity of fund management such as portfolio construction and allocation, research and advisory, business development and marketing or client servicing. They may include the directors and CEO of the FMC. Representatives are required to meet applicable minimum entry and examination requirements as set out in the “Notice on Minimum Entry and Examination Requirements for Representatives of Holders of Capital Markets Services licence and Exempt Financial Institutions under the SFA [SFA04-N09]” and any other relevant notices issued by MAS. |

^ The relevance of an individual’s past experience should be assessed in the context of the role that the individual will perform in the FMC. For example, experience in proprietary trading for financial institutions could be counted towards meeting the relevant experience requirement for the two relevant professionals. Relevant experience may also include sector experience (e.g. corporate strategy and management of businesses), particularly for private equity and venture capital FMCs. Directors and the CEO should have managerial experience or experience in a supervisory capacity as part of their relevant experience.

Appendix 2: Minimum Compliance Arrangements for Singapore Fund Management Company Registration and Ongoing Obligation

| Category | Minimum Requirements |

| Retail LFMCs |

|

| A/I LFMCs

(AUM ≥ S$1b) |

|

| A/I LFMC

(AUM < S$1b) |

(i) designate a senior staff independent from the front office (e.g. COO or CFO) to be responsible for compliance, or (ii) demonstrate that there is adequate compliance oversight and support from an independent and dedicated compliance team at its holding company, or an overseas related entity.

|

| RFMC |

|

VALON can be your resource and business partner in Asia. Should you wish to receive more detailed information on VALON, please do not hesitate to contact us at enquiry@valoncorp.com.

Disclaimer: This publication does not provide financial, legal or tax or advice of any kind, and VALON cannot guarantee that the information is accurate, complete or up-to-date. While we intend to make every attempt to keep the information in this publication current, VALON make no claims, promises or guarantees about the accuracy, completeness or adequacy of the information contained herein. Nothing on this publication should be used as a substitute for the advice of a third party. VALON assumes no responsibility to any person who relies on information contained herein and disclaim all liability in respect to such information. You should not act upon information in this publication without seeking professional advice.